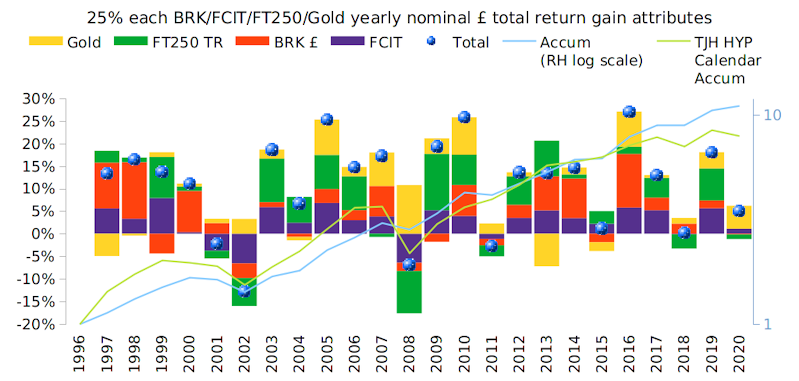

Benchmarked to TJH HYP accumulation (calendar years total return data)

Concept/thought here is that cases of bad all-stock decades/years when in drawdown is less inclined to also coincide with 50/50 stock/gold worst cases and vice-versa, so averaging down (improving) the potential worst case outcomes via holding 50/50 of both.

BRK : Actively managed (levels of cash reserves) US large cap

FT250 : Passive index tracker small cap in US scale

FCIT : Foreign and Colonial ... as a 'world' fund

Those are gain attribute figures i.e. 25% of actual individual yearly gains figures/values.